STAR GROUP (SGU)·Q1 2026 Earnings Summary

Star Group Surges 32% on EBITDA as Cold Winter Fuels Heating Demand

February 5, 2026 · by Fintool AI Agent

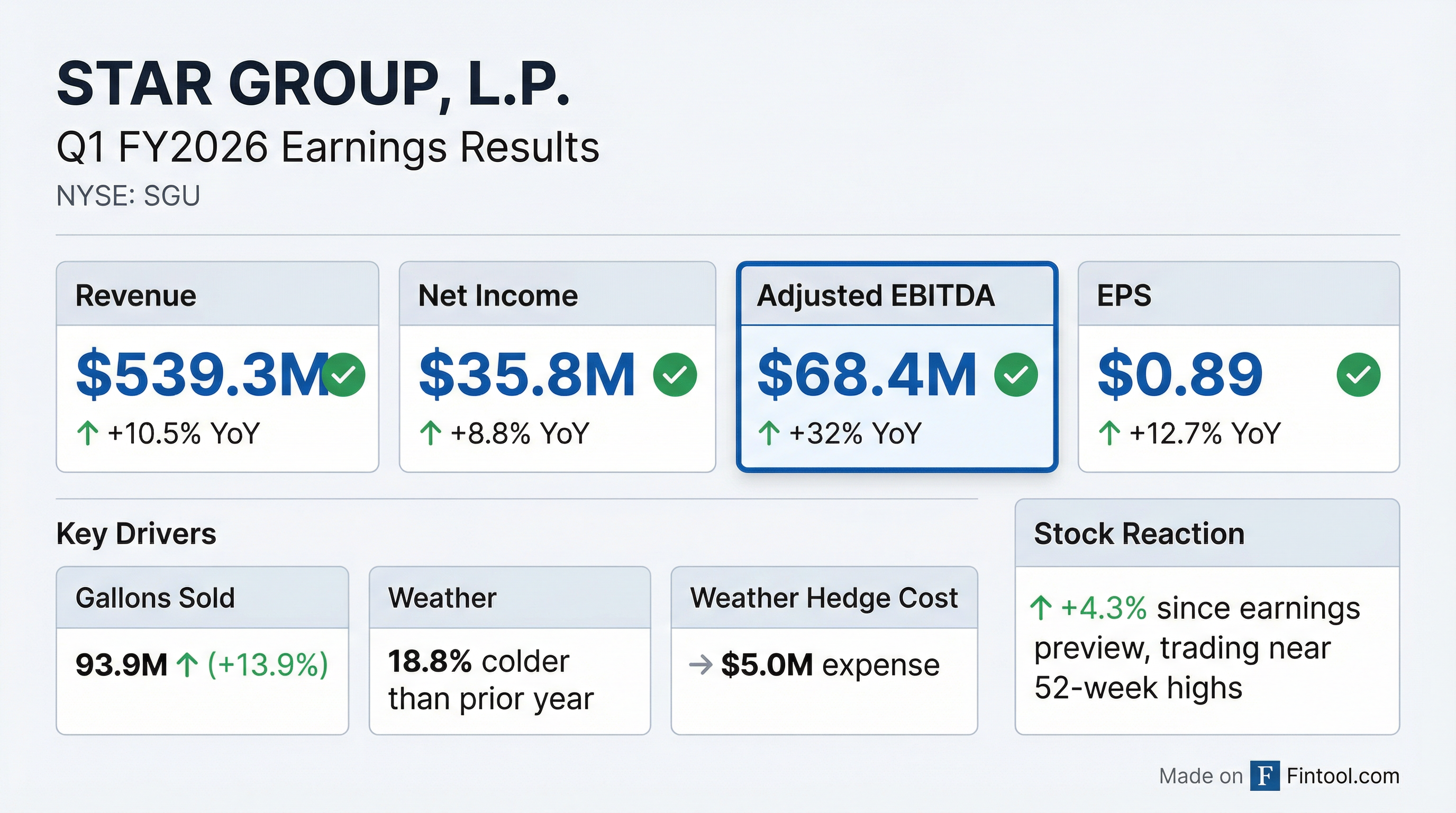

Star Group, L.P. (NYSE: SGU), the nation's largest retail distributor of home heating oil, reported fiscal Q1 2026 results that exceeded prior-year performance across all key metrics. A significantly colder winter drove heating oil and propane volumes up 14% to approximately 94 million gallons, while recent acquisitions and operational efficiency contributed to a 32% surge in Adjusted EBITDA to $68 million—net of a $5 million weather hedge expense.

Did Star Group Beat Expectations?

Star Group is a small-cap MLP with limited sell-side analyst coverage, making year-over-year comparisons the most relevant benchmark.

The standout metric was Adjusted EBITDA, which jumped $16.5 million (32%) year-over-year despite a $5.0 million weather hedge expense that wasn't present in the prior year period.

What Drove the Strong Quarter?

Three factors converged to deliver exceptional results:

1. Colder Weather (+$16.8M base business EBITDA)

Temperatures in Star Group's Northeast and Mid-Atlantic service areas were 18.8% colder than the prior year and 6.1% colder than normal, according to NOAA data. This drove a 13.9% increase in heating oil and propane gallons sold, from 82.4 million to 93.9 million gallons.

2. Acquisitions (+$4.7M EBITDA)

Recent acquisitions contributed $4.7 million in Adjusted EBITDA, demonstrating Star Group's continued consolidation strategy in the fragmented home heating market.

3. Margin Management

CEO Jeff Woosnam highlighted "effective physical supply and per-gallon margin management" as a key contributor to the quarter's success, alongside the company's expanding service and installation initiative.

What Did Management Say?

"Fiscal 2026 has started off very well as our performance benefited from recent acquisitions, physical supply, and per-gallon margin management, the continued focus on service and installation profitability, and last but not least, temperatures that were almost 19% colder than last year and 6% colder than normal."

— Jeff Woosnam, President and CEO

"I'm very proud of the way our employees have responded to the added demand and the challenges of making deliveries in snow and ice conditions. They have worked tirelessly, at times through difficult conditions, to provide our customers with the level of service and responsiveness they have come to expect."

— Jeff Woosnam, President and CEO

What's the Weather Hedge Impact?

Star Group maintains weather derivative contracts to hedge against warm winters. In Q1 FY2026, because temperatures were colder than the hedge strike prices, the company recorded a $5.0 million expense under these contracts—compared to no expense or benefit in Q1 FY2025.

This weather hedge acts as insurance: the company pays when winters are cold (when volumes are strong anyway) and receives payments when winters are warm (offsetting lost volume). The $5.0M cost this quarter was more than offset by the $16.5M EBITDA gain.

How Did the Stock React?

SGU shares have performed well heading into and following earnings:

The stock is trading near 52-week highs, with aftermarket trading pushing above $13.40. This reflects investor optimism about the cold winter extending into Q2.

What Changed From Last Quarter?

Q1 (Oct-Dec) is the beginning of Star Group's peak heating season. The sequential improvement from Q4 reflects normal seasonality—heating oil companies are highly seasonal, with Q2 (Jan-Mar) typically the strongest quarter and Q3-Q4 (Apr-Sep) generating losses.

Balance Sheet Highlights

The company drew on its revolver during the quarter to fund seasonal working capital needs (receivables grew by $96M as heating season ramped). This is typical for heating distributors and will unwind as collections normalize in spring.

Seasonal Context: Historical Q1 Performance

Star Group's fiscal year ends September 30. Q1 (Oct-Dec) and Q2 (Jan-Mar) are the profitable quarters when heating demand peaks. Here's how Q1 FY2026 compares:

*Note: Q1 FY2024 data from prior year comparisons in this filing.

The 32% EBITDA growth this quarter is notably strong even accounting for weather, suggesting the company's acquisitions and margin management initiatives are paying off.

Forward Outlook

Management provided qualitative commentary rather than formal guidance:

- Cold weather continuing: January finished 2% colder than last year and 9% colder than normal, with February starting cold and a strong forecast ahead

- Customer attrition: Net customer attrition was described as "modest" during the period, partially offset by acquisitions and weather

- Service expansion: The company continues to focus on service and installation profitability, which provides recurring revenue and is less weather-dependent

- M&A pipeline: Several opportunities under review, with new prospects expected as spring approaches

Key Risks to Monitor

- Weather Dependency: A warm February-March would significantly impact Q2 results

- Customer Attrition: Conversion to natural gas and electrification of heating systems remain structural headwinds

- Commodity Exposure: While margins have been well-managed, heating oil price volatility could impact results

- Acquisition Integration: Continued M&A is core to the strategy; execution risk exists

Q&A Highlights

The earnings call featured limited Q&A, with one question from Tim Mullen at Laurelton Management about operational updates into Q2.

On Q2 weather and operations:

"January was colder than normal. February is starting off that way, and we've got a pretty strong forecast in front of us, and we've been dealing with some storms. So conditions have definitely been a challenge for us, but frankly, this is what we're built for as a full-service provider, and this is what we plan for."

— Jeff Woosnam, President and CEO

CEO Woosnam emphasized employee performance: "I'm just always amazed at how our employees really just step up and get a lot of satisfaction out of taking care of our customers."

January Weather Update

Cold weather has continued into Q2, supporting the outlook for the peak heating quarter:

Employees have been working through snow and ice conditions to maintain service levels during the extended cold snap.

M&A Update

Star Group completed one acquisition just days before the earnings call—a small heating oil business.

Management noted it's typical to see a lull in M&A prospect activity during busy heating season, but they have "several opportunities under various stages of review" and expect new prospects as spring approaches.

Detailed Segment Performance

CFO Rich Ambury provided additional color on the quarter's results:

Product Gross Profit:

- Increased $29M (+19%) to ~$179M

- Driven by higher volumes and improved per-gallon margins

Service & Installation:

- Combined gross profit: $5.6M (vs. $6.9M prior year)

- Installation gross profit: +$1.4M improvement

- Service gross profit: -$2.7M decline due to high demand from cold weather and increased propane tank sets

Operating Expenses (+$11M total):

- Weather hedge contracts: $5.0M (colder than strike price)

- Delivery expenses: +$3.8M (+13%, tracking with 14% volume increase)

- Other operating costs: +$2.2M (~2% increase)

Non-Cash Items:

- Fair value of derivatives: $5M charge vs. $5M credit in prior year ($10M YoY swing)

- Higher D&A and interest expense: $1.7M (due to acquisitions)

- Higher income tax: $1.3M

Bottom Line

Star Group delivered a strong start to fiscal 2026, with Adjusted EBITDA up 32% as a cold winter boosted heating demand. The company's acquisition strategy and operational execution continue to drive results, though the business remains highly weather-dependent. With cold temperatures persisting into Q2, the setup for the peak heating quarter looks favorable. The stock is trading near 52-week highs, reflecting optimism about the winter heating season.